support@zurihr.com

+254 757 012345

Don’t Let 30th June Sneak Up on You – File Your KRA Individual (P9) Returns in a Flash with Zuri HR!

Tax season might not be everyone’s idea of a party, but with Zuri HR by your side, it can feel more like a breeze than a battle. If you’re an employee or employer in Kenya, the looming 30th June deadline for filing your KRA Individual (P9) Returns is fast approaching. Here’s how you can turn that P9 data into a done deal—without breaking a sweat.

Your P9 is more than just a piece of paper – it’s the definitive statement of your annual pay and tax deductions. The Kenya Revenue Authority uses it to cross-check what you’ve earned versus what you’ve paid. Filed correctly, it means:

✔️ Peace of Mind: No surprise tax bills later.

✔️ Compliance Confidence: Stay on KRA’s good side.

✔️ Financial Clarity: Know exactly where you stand.

Miss the 30th June cut-off, and you risk penalties (and possibly a very unfriendly letter from KRA). But don’t panic—Zuri HR has your back.

Log In to Your ESS Account

Head over to your Zuri HR Employee Self-Service portal and sign in with your credentials.

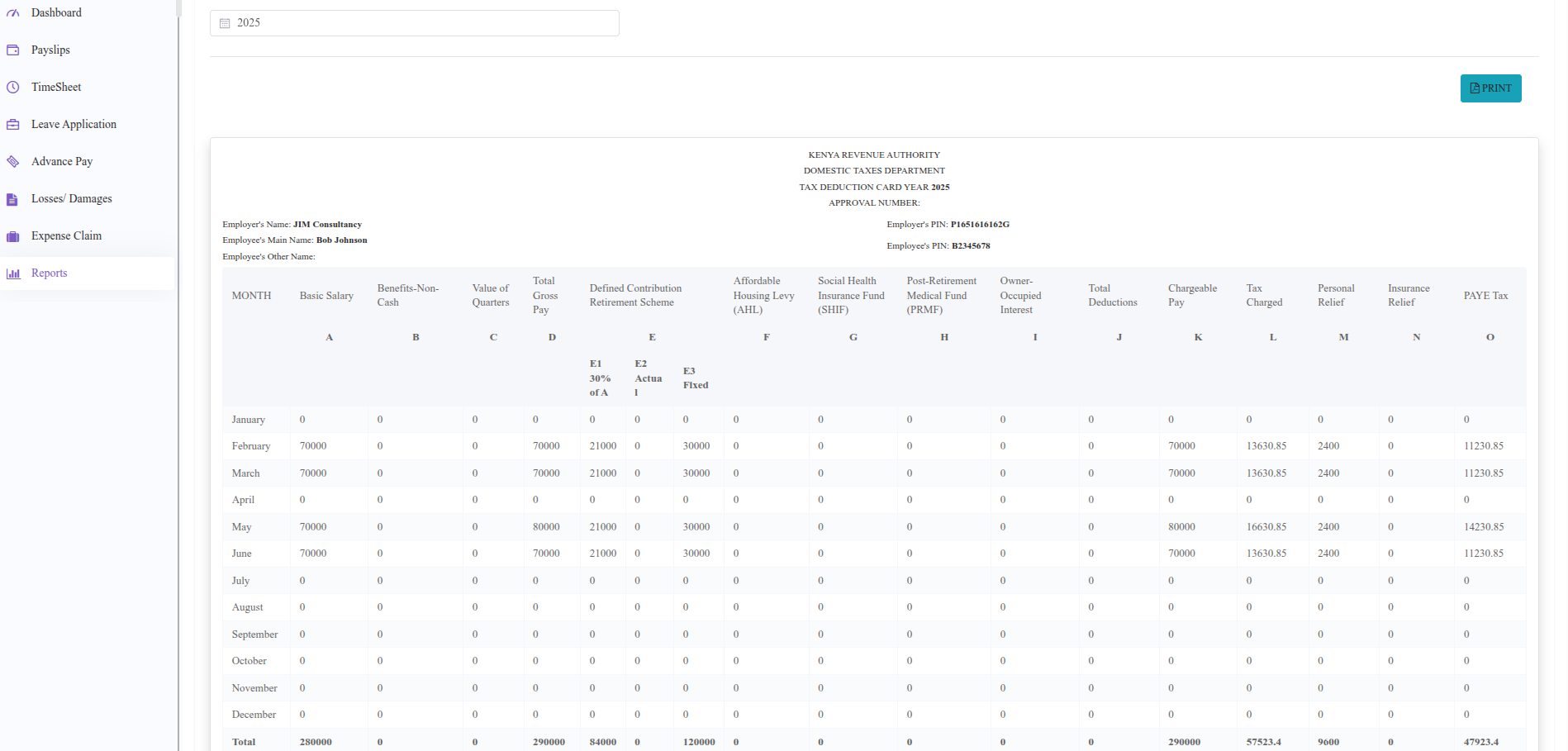

Navigate to Reports → P9 Report

Once inside, look for the Reports menu. Click P9 Report, and voilà—your complete year-to-date earnings and deductions will appear, ready for action.

Download and Save

Hit Download, and your P9 is yours in PDF format. Keep it safe—you’ll need these figures for the next step.

Armed with your freshly downloaded P9, open the official KRA Individual Returns Excel sheet. You’ll find fields for:

Simply copy the numbers from your Zuri HR P9 and paste them into the corresponding cells in the KRA sheet. The built-in formulas will calculate your final tax liability instantly.

Time flies, and so does June 30th. Set yourself up for success by grabbing your P9 from Zuri HR today. Don’t wait until the eleventh hour—log in, pull your report, and file your returns with confidence.

Ready, Set, File!

Get into Zuri HR ESS now, download your P9, and conquer your tax returns before 30th June. You’ve got this!

June 13, 2025 - BY Admin

June 13, 2025 - BY Admin